February 22, 2023 | Kneat Announces Record SaaS Revenue for Fourth Quarter and Full Year 2022

SaaS Annual Recurring Revenue Growth Accelerates to 95%

LIMERICK, Ireland, February 22, 2023 – kneat.com, inc. (TSX: KSI, OTC: KSIOF) (“Kneat” or the “Company”) a leader in digitizing and automating validation and quality processes, today announced financial results for the three- and twelve-month periods ended December 31, 2022. All dollar amounts are presented in Canadian dollars unless otherwise stated.

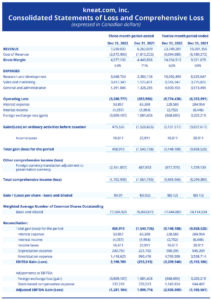

• Fourth-quarter total revenue reaches $7.3 million, an increase of 16% year over year

• Annual Recurring Revenue (ARR1) at December 31, 2022 reaches $24.2 million, an increase of 85% year over year

• SaaS ARR1 at December 31, 2022 reaches $23.7 million, an increase of 95% year over year

As the largest global companies in life sciences continue to gain real business value from Kneat’s purpose-built software, they are buying more, and leading the way for others in the industry to follow. Our focused, dedicated team of people crafting great software, combined with a growing marketing and sales muscle, will continue to build momentum for Kneat, as we support life sciences companies in bringing health and wellness innovations to market – at scale, with speed, and in a trusted way.

-said Eddie Ryan, Chief Executive Officer of Kneat.

Q4 2022 Highlights

- Total revenues increased 16% to $7.3 million in the fourth quarter of 2022, compared to $6.3 million for the fourth quarter of 2021. The fourth quarter of 2021 included one-time upfront on-premise license fees revenue associated with the scaling of on-premise licenses with existing legacy customers, and was also favorably impacted by the timing of professional services revenue service milestones being met.

- SaaS revenue for the fourth quarter of 2022 grew 87% to $5.7 million, versus $3.0 million for the fourth quarter of 2021.

- Fourth-quarter 2022 gross profit was $4.6 million, up slightly from $4.4 million in gross profit for the fourth quarter of 2021.

- Gross margin in the fourth quarter of 2022 was 63%, compared to 71% for the fourth quarter of 2021, and 61% for the third quarter of 2022. The year-over-year difference in gross margin reflects the favorable timing impacts of on-prem license fee and professional service revenue in the fourth quarter of 2021 described above.

- EBITDA1 in the fourth quarter of 2022 was $2.2 million, compared with ($0.3) million for the fourth quarter of 2021.

- Adjusted EBITDA1 in the fourth quarter of 2022 was ($1.3) million, compared with $1.1 million for the fourth quarter of 2021.

- Total ARR1, which includes SaaS license and recurring maintenance fees, was $24.2 million at December 31, 2022, an increase of 85% from $13.1 million at December 31, 2021.

- SaaS ARR1, the proportion of ARR attributable to SaaS licenses, was $23.7 million at December 31, 2022, an increase of 95% from $12.2 million at December 31, 2021.

- In October 2022, Kneat signed a three-year Master Services Agreement with a top-tier Fortune 500 healthcare company. In the same month, Kneat closed a significant expansion and transition to SaaS with one of its top ten global pharmaceutical customers with a new three-year SaaS Master Services Agreement. The customer will scale to 2,000 users initially with a plan to expand to 6,000 over the contract term.

- In November 2022, Kneat hosted more than twice as many attendees at its user conference, VALIDATE, than at the previous conference in 2019. The conference was successful on several levels, as 100% of respondents to an attendee survey said they would recommend VALIDATE to their colleagues; 100% of VALIDATE’s sponsors said they would sponsor again; and the Kneat team captured valuable input from its engaged users to inform future product development.

Full Year 2022 Highlights

- Total revenues for the full year 2022 increased 53% to $23.7 million, compared to $15.5 million for 2021.

- SaaS revenue doubled, reaching $17.3 million for the full year 2022, versus $8.7 million for 2021.

- Full-year 2022 gross profit was $14.7 million, an increase of 57% compared to $9.3 million for the full year 2021.

- Gross margin for the full year 2022 was 62%, compared to 60% for all of 2021.

- EBITDA1 for the full year 2022 was ($3.2) million, compared with ($5.2) million for all of 2021.

- Adjusted EBITDA1 for the full year 2022 was ($2.9) million, compared with ($1.1) million for all of 2021.

- Kneat signed on a major consumer packaged goods company, demonstrating applicability of its user-friendly, purpose-built, real-time eValidation software to verticals outside of life science.

- In March 2022, Kneat’s eValidation platform was selected by a European National Health Service, a Top Ten Biopharmaceutical company and a leading Canadian-headquartered generics pharmaceutical manufacturer.

Kneat’s momentum in gaining new customers continued into 2023:

- In January 2023, Kneat closed a three-year MSA with Fresenius Kabi, a leading global healthcare company with more than 40,000 employees. While the initial deployment is across five sites for validating production equipment, facilities and utilities, Kneat’s demonstrated track record of delivering a strong ROI to its life sciences customers positions Kneat to scale to multiple manufacturing sites and processes across Fresenius Kabi. Fresenius Kabi is an independent subsidiary of Fresenius, a more than 300,000-employee global healthcare group.

- In January 2023, one of Kneat’s largest pharmaceutical customers, which is one of its few remaining on-premise deployments, signed a three-year master agreement to transition to a SaaS deployment, easing the way for further expansion over the coming years.

Strategic Business Developments

- In March 2022, Kneat’s common shares commenced trading on the OTCQX® Best Market and became eligible for electronic clearing and settlement in the United States through the Depository Trust Company (“DTC”).

- June 2022, Kneat added an accomplished global sales executive, Jacob Hahn Michelsen, to lead our growing sales team, which now covers most of the United States and Europe.

- Kneat was recognized as one of the fastest-growing tech companies in Ireland for the second year in a row.

- In response to the expansive, near-term opportunity to digitize validation for the life sciences industry, Kneat continued to invest in its business throughout 2022 by expanding its ranks, primarily in sales and marketing and research and development. Kneat expanded its team considerably in 2022, ending the year with 261 employees.

- Kneat’s rapid growth extended to its customer base and partner community, which grew by 48% and 61% respectively over the course of 2022.

1ARR and SaaS ARR are supplementary measures. EBITDA and Adjusted EBITDA are non-IFRS measures and are not recognized, defined or standardized measures under IFRS. These measures are defined in the “Supplementary and Non-IFRS Measures” section of this news release.

With our excellent results in the fourth quarter, it’s clear our careful investments to grow Kneat’s capabilities are paying off. Our sales and marketing team is expanding Kneat’s footprint within our customer base while continuing to win new customers. At the same time, our research and development team is building out our platform to expand Kneat’s use cases. These investments set us up to grow revenue faster than operating costs in 2023, even as we continue hiring opportunistically to strategically expand our customer base and use cases. With this momentum, along with our solid financial position, we are looking forward to what this powerful combination can do in 2023.

-said Hugh Kavanagh, Chief Financial Officer of Kneat.

Quarterly Conference Call

Mr. Eddie Ryan, Chief Executive Officer of Kneat, and Mr. Hugh Kavanagh, Chief Financial Officer of Kneat, will host a conference call to discuss Kneat’s third-quarter results and hold a Q&A for analysts and investors via webcast on February 23, 2023, at 9:00 a.m. ET.

Interested parties can register for the live webcast via the following link:

Or, attend via teleconference:

Ireland +353 16 572 652

Canada +1 (647) 497-9388

United States +1 (562) 247-8421

United Kingdom +44 330 221 9922

If attending via teleconference, please register via the link above to access the dial-in pin code required to attend. The dial-in pin code is available in your confirmation email.

Supplementary and Non-IFRS Financial Measures

The Company uses supplementary financial measures as key performance indicators in its MD&A and other communications. Management uses both IFRS measures and supplementary, non-IFRS financial measures as key performance indicators when planning, monitoring and evaluating the Company’s performance.

Annual Recurring Revenue (“ARR”)

ARR is used by Kneat to assess the expected recurring revenues from the customers that are live on the Kneat Gx platform at the end of the period. ARR is calculated as the licenses delivered to customers at the period end, multiplied by the expected customer retention rate of 100% and multiplied by the full agreed SaaS license or maintenance fee. Since many of the customer contracts are in currencies other than the Canadian dollar, the Canadian dollar equivalent is calculated using the related period end exchange rate multiplied by the contracted currency amount.

Software-as-a-Service Annual Recurring Revenue (“SaaS ARR”)

SaaS ARR is a component of ARR that is used by Kneat to assess the expected recurring revenues exclusively from license subscriptions to the Kneat Gx platform at the end of the period. SaaS ARR is calculated as the SaaS licenses delivered to customers at the period end, multiplied by the expected customer retention rate of 100% and multiplied by the full agreed SaaS license fee. Since many of the customer contracts are in currencies other than the Canadian dollar, the Canadian dollar equivalent is calculated using the related period end exchange rate multiplied by the contracted currency amount.

Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”)

EBITDA is calculated as net income (loss) attributable to kneat.com excluding interest income (expense), provision for income taxes, depreciation and amortization. We provide and use this non-IFRS measure of our operating performance to highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. A reconciliation of EBITDA to IFRS financial measures is provided in the financial statements accompanying this press release.

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

Adjusted EBITDA is calculated as net income (loss) attributable to kneat.com excluding interest income (expense), provision for income taxes, depreciation and amortization and stock-based compensation expense. We provide and use this non-IFRS measure of our operating performance to highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures and to inform financial comparisons with other companies. A reconciliation of Adjusted EBITDA to IFRS financial measures is provided in the financial statements accompanying this press release.

About Kneat

Kneat, a Canadian company with operational headquarters in Limerick, Ireland, develops and markets the next-generation Kneat Gx SaaS platform. Multiple business work processes can be configured on the platform from equipment to computer system validation, through to quality document management. Kneat’s software allows users to author, review, approve, execute testing online, manage any exceptions, and post-approve final deliverables in a controlled FDA 21 CFR Part 11/ EU Annex 11 compliant platform. Macro and micro report dashboards enable powerful oversight into all systems, projects and processes globally. Customer case studies are reporting productivity improvements in excess of 100% and a higher data integrity and compliance standard. For more information visit www.kneat.com

Cautionary and Forward-Looking Statements

Except for the statements of historical fact contained herein, certain information presented constitutes “forward-looking information” within the meaning of applicable Canadian securities laws. Such forward-looking information includes, but is not limited to, the relationship between Kneat and the customer, Kneat’s business development activities, the use and implementation timelines of Kneat’s software within the customer’s validation processes, the ability and intent of the customer to scale the use of Kneat’s software within the customer’s organization, our ability to win business from new customers and expand business from existing customers, and the compliance of Kneat’s platform under regulatory audit and inspection. These and other assumptions, risks and uncertainties may cause Kneat’s actual results, performance, achievements and developments to differ materially from the results, performance, achievements or developments expressed or implied by forward-looking statements.

Material risks and uncertainties relating to our business are described under the headings “Cautionary Note Regarding Forward-Looking Statements and Information” and “Risk Factors” in our annual MD&A dated February 22, 2023, under the heading “Risk Factors” in our Annual Information Form dated February 22, 2023 and in our other public documents filed with Canadian securities regulatory authorities, which are available at www.sedar.com. Forward-looking statements are provided to help readers understand management’s expectations as at the date of this release and may not be suitable for other purposes. Readers are cautioned not to place undue reliance on forward-looking statements. Kneat assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as expressly required by law. Investors should not assume that any lack of update to a previously issued forward-looking statement constitutes a reaffirmation of that statement. Continued reliance on forward-looking statements is at an investor’s own risk.

For further information:

Katie Keita, Kneat Investor Relations

P: + 1 902-706-9074

E: [email protected]

Contact

Talk to us

Find out how Kneat can make your validation easier, faster, and smarter.

Start your paperless validation revolution by speaking to our experts.